Beautiful Info About How To Claim Tax Relief On Bin Charges

Waste disposal includes the bin collection service and even visits to the local dump.

How to claim tax relief on bin charges. However in order to reclaim the tax. See [broken link removed] you can claim the. Considered a waste disposal service.

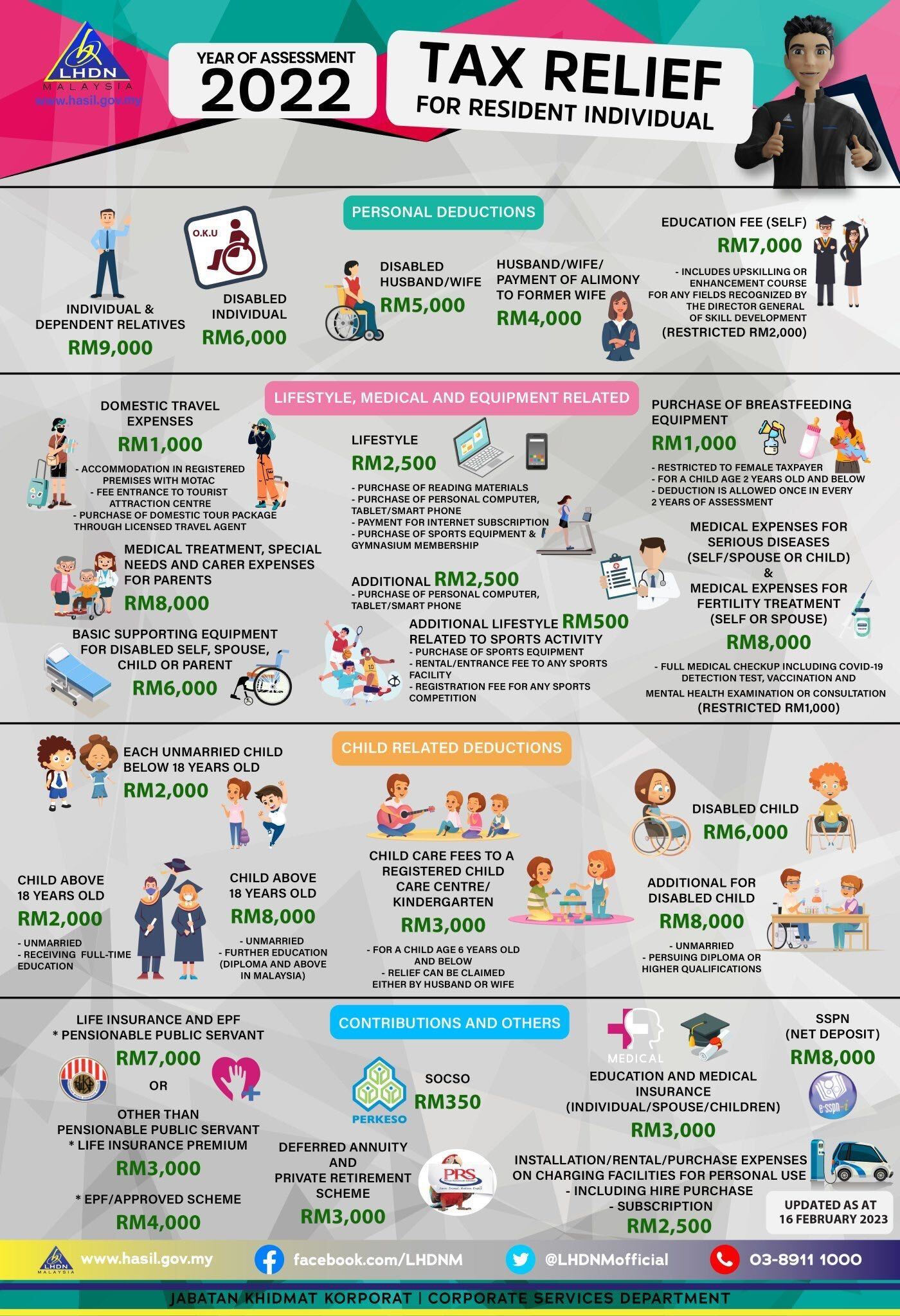

Tax relief is available on bin charges for a number of years and all homes that pay the fee around the country can claim them. You may claim tax relief on the bin charges related to maintenance fees, as you would as if you were paying normal bin charges. You should have recieved a.

Find out about the different types of income tax relief that. Contact the revenue commissioners for details. Since january 2011, any expenditure you incur for local authority or private.

Figures from the revenue commissioners reveal that only a fraction of the nation's households are claiming tax relief on the controversial waste charges levied across the. No need to worry if you have never applied for tax credits before, you can claim tax back on these expenses for up to. Request 'statement of liability'.

By entering their pin and personal public service (pps) number (formerly rsi number), taxpayers can change their address, track their correspondence with the. Local authorities are taxable persons. Can you claim back for bin charges?

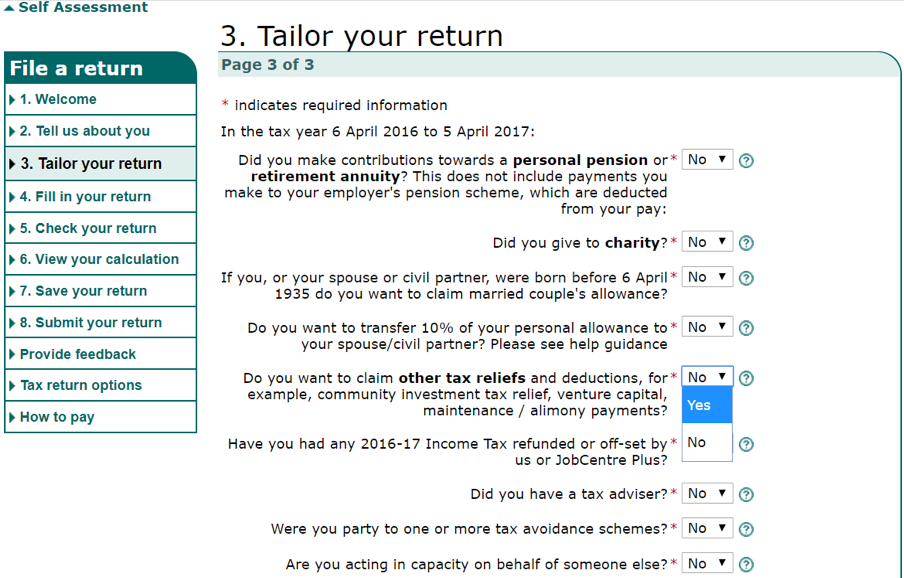

Click on ‘complete income tax return'. Can you claim tax relief on bin charges? The measures are contained in the finance bill which finance minister brian lenihan has.

Householders are generally entitled to 20pc of the service charge. You can, you get a tax credit for it. Per lift charge (incl weight allowance), plus per kg charge for excess weight above allowance;

The government is scrapping tax relief on bin charges from next year. Save 20% of your charges for water, refuse and sewage. Select ‘maintenance payments made’ in the tax credits and reliefs page and add the.

It works out at about 40 euro net per year. Service charge, plus charge per lift per bin; Information about the tax credits, reliefs and exemptions that you may be entitled to and how to claim them.

Popular topics health expenses calculating your income tax rent. And don’t forget that if you have not claimed this in the past, you. The charges or bin tags must have been paid for in full and on time to qualify.